Automotive wiring harnesses and connectors are important components of the vehicle's electronic and electrical architecture. With the trend of automobile three-dimensionalization and E/E architecture upgrades, the industry has ushered in a good opportunity for development. This report disassembles in detail the new application areas of automotive wiring harnesses and connectors under the trend of electric intelligence, estimates the industry market space, and summarizes the common development paths of overseas wiring harness and connector leaders. We are optimistic about the incremental growth space of high-voltage and high-speed connectors brought by electric intelligence, and are also optimistic about the domestic substitution and overseas opportunities of domestic leading wiring harness manufacturers during the window period of pattern reshaping.

With the loosening of policies, the global SBW wire-controlled steering market size is expected to exceed 100 billion yuan in 2030. At the beginning of 2022, the new national standard for automotive steering deleted the requirement that full power steering mechanisms must not be installed (wire-controlled steering is full power steering), which had been implemented for 20 years. Wire-controlled steering is expected to gradually replace traditional steering systems under the trend of intelligence. According to the "Smart Electric Chassis Technology Roadmap" released by the Electric Vehicle Alliance, the goal is: the penetration rate of wire-controlled steering will reach 5% in 2025 and 30% in 2030. We estimate that the global market size of wire-controlled steering will be RMB 18.6 billion in 2025 and RMB 100.4 billion in 2030, with a GAGR of 40.2% during the period, the market size of wire-controlled steering in China will be RMB 6.3 billion in 2025 and RMB 37.6 billion in 2030, with a GAGR of 42.8% during the period.

1. Definition of hardware-software integration and analysis of the current status of the industry

1. Wiring harnesses and connectors are the blood vessels and nerves of electronic systems and are widely used in many parts of automobiles

1.1 Wiring harnesses: design and manufacturing are equally important, and the industry is shifting from cost competition to comprehensive capability competition

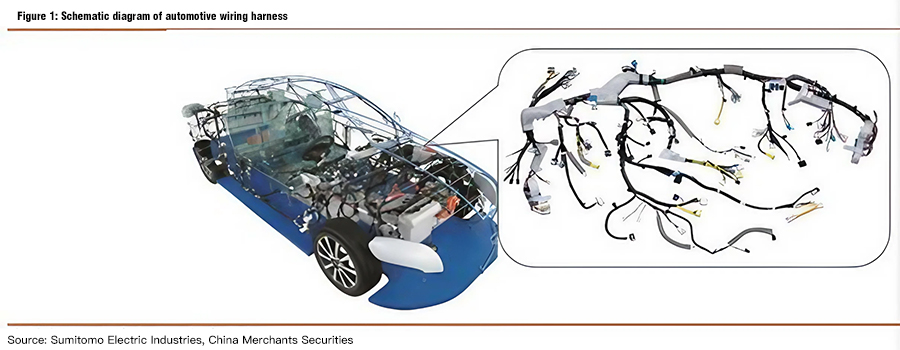

The automotive wiring harness is the network body of the automotive electronic circuit and the blood vessels and nerves of the automotive electronic system. The wiring harness is a component that connects the circuit by crimping the connector and the wire and cable, and then bundling it with a plastic-pressed insulator or an external metal shell, its basic function is to ensure reliable electrical connection of electronic components during their service life. The wiring harness transmits power and signals to various parts of the car by connecting electronic components, ECUs, sensors, actuators and other electronic and electrical equipment in the car.

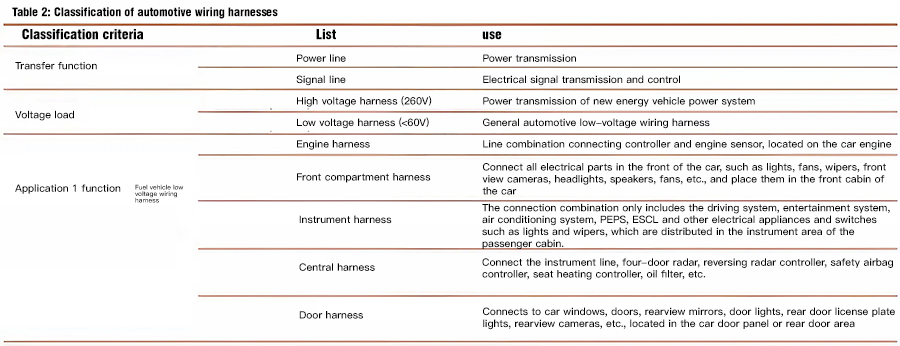

There are many types of automotive wiring harnesses, which can be classified in many ways, such as transmission function, voltage range, and application location. 1) According to the transmission function, they can be divided into power lines and signal lines. Among them, power lines use thick wires, and signal lines are copper multi-core soft wires with better shielding. 2) According to the voltage range, they can be divided into high-voltage wiring harnesses and low-voltage wiring harnesses. The voltage of high-voltage wiring harnesses is above 60V, and its heat resistance, voltage resistance, and anti-electromagnetic interference characteristics are better than those of low-voltage wiring harnesses. 3) According to the application location of the car, it can be divided into automotive wiring harnesses for the cabin, cockpit, chassis, etc., as well as the newly added three-electric system and high-voltage accessory wiring harnesses in new energy vehicles.

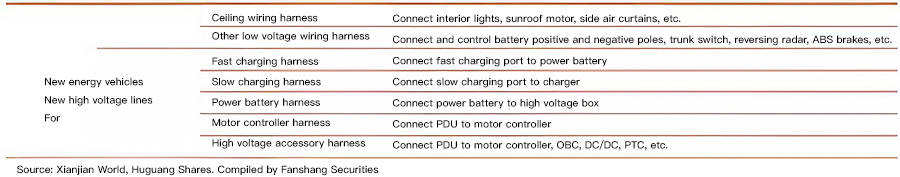

From the perspective of the industrial chain, the automotive wiring harness industry is a vertically integrated chain supply model, with wiring harnesses as the midstream link. As a first-tier supplier, automotive wiring harness factories purchase connectors, cables and other parts and produce and assemble them, and provide wiring harness assembly products to downstream vehicle manufacturers.

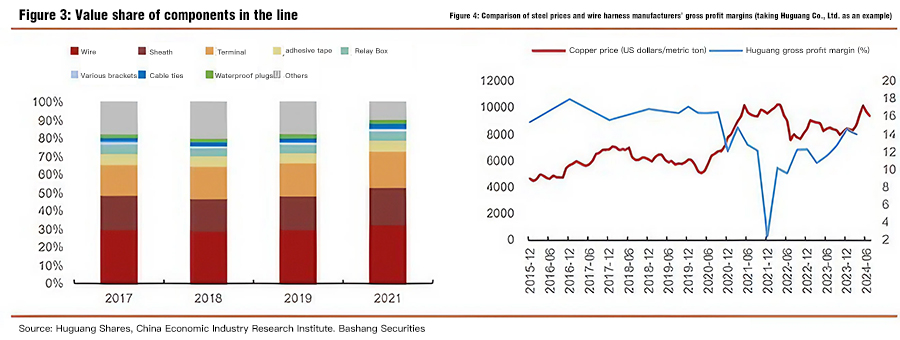

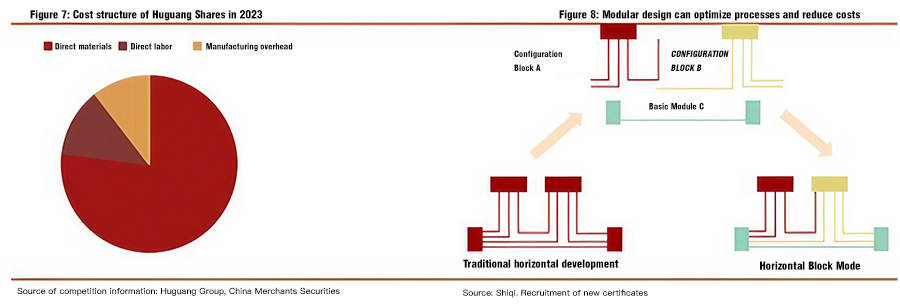

➢ Upstream: The wiring harness is composed of cables, connectors, tapes, buckles, sheaths, various brackets, etc., among which connectors and cables are of the highest value, accounting for more than 40% and 30% of the wiring harness cost respectively (according to the announcement of Huguang Company). The raw materials involved in the above products include copper, rubber, plastic, etc. The price fluctuations of bulk commodities represented by copper have a potential impact on the market price and performance of wiring harness companies.

➢ Downstream: The downstream customers of the domestic automotive wiring harness industry are mainly domestic and foreign automotive OEMs, supplemented by some parts and components suppliers, and the customer concentration is relatively high.

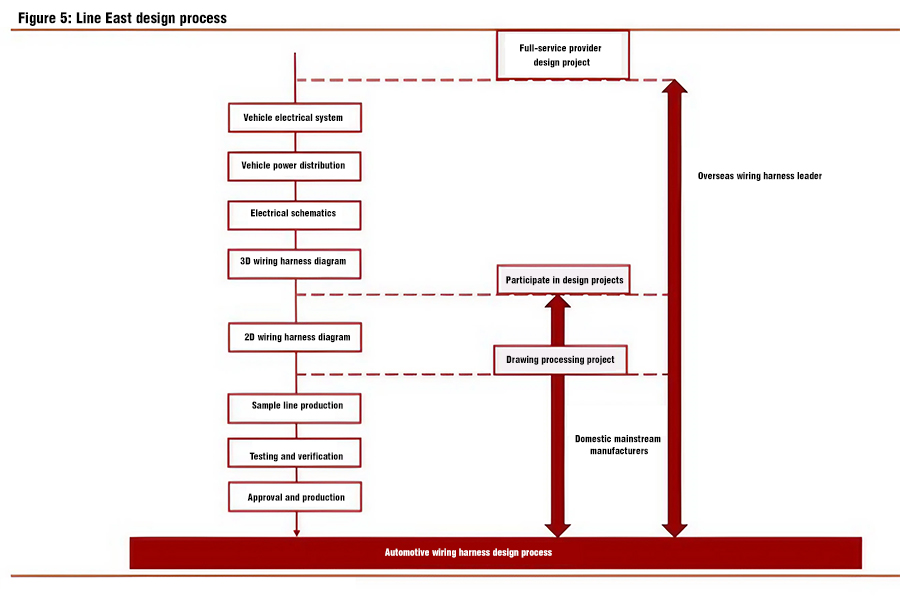

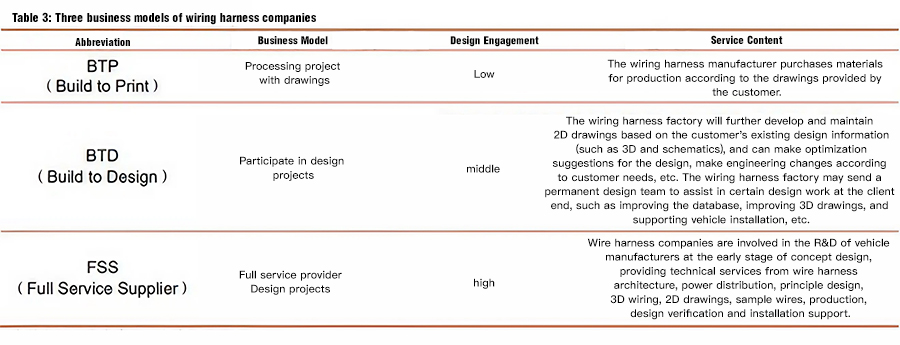

In the design stage, the current participation of domestic manufacturers in the early stage is relatively low, and comprehensive design and development capabilities will become an important criterion for future wiring harness manufacturers. The wiring harness design process usually includes demand analysis, schematic design, 3D wiring harness diagram, 2D wiring harness diagram, sample line production, test verification, etc. According to the design participation from low to high, the business model of wiring harness companies can be divided into three categories: BTP (processing project with drawings)/BTD (participation in design project)/FSS (full service supplier design project).

➢ Domestic manufacturers: The current service model is mainly drawing processing and partial participation in design, and the full service capability is weak, so more participation is in small wiring harnesses such as door wiring harnesses/ceiling wiring harnesses or secondary matching.

➢ Overseas wiring harness giants: relying on their own advantages to become full-service strategic partners, join the OEM development system, and enjoy higher bargaining power and long-term development space. Typical representatives such as Yazaki, as an EEDDS supplier, have deep development experience in various fields of vehicle electrical systems, so as to participate in the early stage development of automotive wiring harnesses.

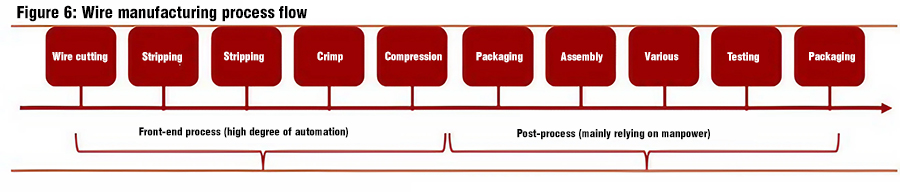

In the manufacturing process, wire harness processing is still a labor-intensive enterprise, and the back-end process has a high demand for manpower, and the industry automation rate is less than 30%. The wire harness manufacturing process includes four major links: wire opening, crimping, pre-installation, and final assembly. Among them, wire opening and crimping belong to the front-end process, with a high level of automation, while the back-end processes such as pre-installation and final assembly mostly rely on manual assembly, mainly because 1) traditional wire harnesses are thin and soft, and it is not easy for the robot arm to grab and place them, 2) the back-end process involves complex processing, many materials, and difficult merging, which is not conducive to the effective identification and positioning of intelligent equipment. At present, the automation rate of my country's automotive wire harness factories is less than 30%.

Optimizing labor costs and logistics costs and improving design capabilities are expected to increase the profit margins of wire harness companies. According to our analysis, in the automotive wire harness industry, material costs/labor costs/logistics costs account for approximately 70%/20%/4%. Considering that wiring harness manufacturers have low bargaining power over raw materials, optimizing labor costs (such as improving the operational proficiency of employees, moving production capacity to underdeveloped areas such as the central and western regions, and improving the level of automation), improving logistics efficiency (such as producing near raw material suppliers/end customers), and improving production flexibility (such as strengthening early design participation and strengthening modular design of wiring harnesses) have become the key to cost reduction in the industry.

1.2 Connectors: The core components of the wiring harness, mold design and manufacturing process highlight the core barriers

The connectors are located at both ends of the wiring harness and are important components for connecting the wiring harness with electrical equipment. Connectors, also known as plugs, plugs and sockets, transmit current or optical signals between devices, components, equipment and subsystems independently or together with cables, and are necessary components for connecting wiring harness systems. The basic structure of the connector includes contacts, insulators, housings and accessories, among which the contacts (terminals) are the core of the connector.

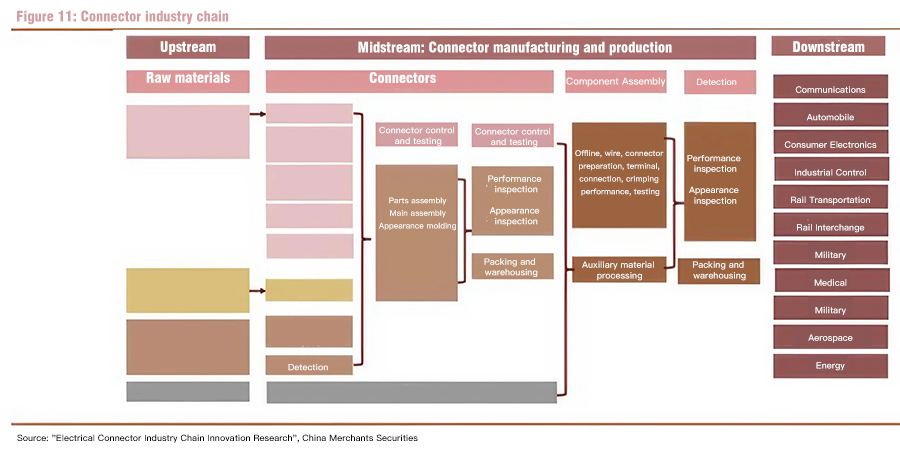

Connectors are located in the middle and upper reaches of the industry chain. The upstream is raw materials such as metals, electroplating liquids, and plastics, the midstream is connector and cable manufacturers, who design, assemble, and manufacture connectors, and the downstream is application manufacturers in the automotive, communications, and other industries.

The key to connector manufacturing lies in mold design and precision manufacturing capabilities. The manufacturing process of connectors includes precision injection molding, precision stamping, die casting, machining, surface treatment, assembly and testing. In terms of design, multidisciplinary composite knowledge is required, and high requirements are placed on software design and simulation technology, in terms of process, high requirements are placed on the manufacturing accuracy of parts and components, and high-precision mold processing equipment and molds are required for production. The processing accuracy of injection molds in the industry is within ±10 microns. A high level of precision mold design and product manufacturing capabilities are conducive to achieving automated production and improving product accuracy and yield.

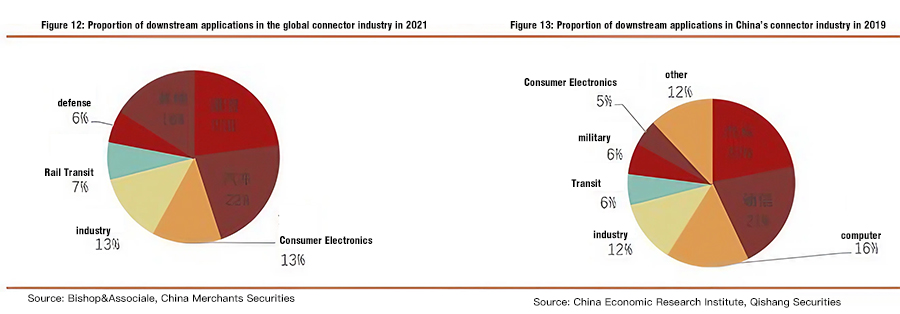

Automobiles are an important downstream application market for connectors, and their core indicators are mechanical properties such as life/impact resistance and electrical properties such as high voltage/anti-interference. Connector applications cover all areas of the electronics industry, including automobiles, communications, computers, industry, and transportation. Among them, communications and automobiles are the largest application scenarios for connectors, with global market shares of 23.47%/21.86% in 2021 (Bishop & Associate). Depending on the application scenario, the functional characteristics and technical level of the connector differ in emphasis. In the automotive industry, electrical indicators such as high voltage and high current and mechanical properties such as mechanical life and impact resistance are key indicators.

2. Market size: Electric intelligence promotes new opportunities for high-voltage and high-speed development. Soft and hard

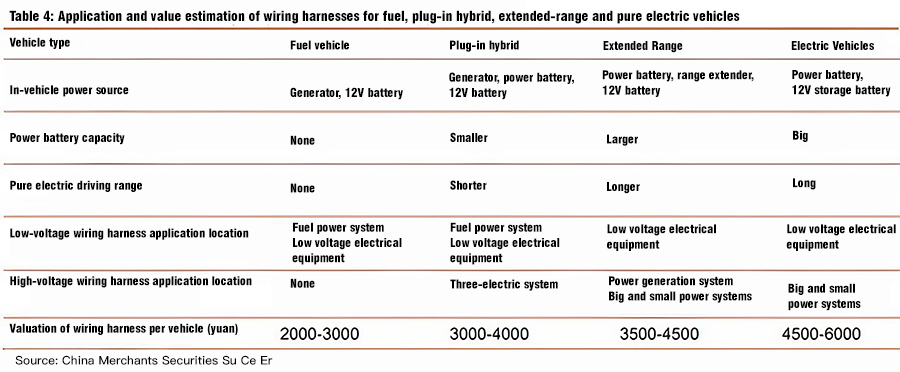

The wiring harness of the whole vehicle can be divided into three categories: ordinary low-voltage wiring harness/high-voltage wiring harness/high-speed wiring harness. In terms of single vehicle value. 1) the value of low-voltage wiring harness for traditional vehicles is basically stable at around 2,000-3,000 yuan. 2) In the process of automobile electrification, the engine wiring harness is gradually cancelled, but at the same time, a high-voltage system wiring harness is added, which has higher requirements for performance and reliability, and the value increment can reach 2,000-3,500 yuan. 3) In the process of automobile intelligence, functional attributes such as autonomous driving, smart cockpits, and vehicle networking have put forward higher requirements for data transmission speed. Depending on the intelligent configuration of the vehicle, the value of the newly added high-speed wiring harness ranges from hundreds to thousands of yuan.

In terms of market size, with the continuous penetration of electrification and intelligence in the global automobile market, the market size of high-voltage and high-speed wiring harnesses for vehicles is expected to continue to grow. We estimate that the total sales volume of the global automobile market will be 95 million units in 2026, the penetration rate of new energy will reach 26%, and the penetration rates of L0, L1, L2/L3, L4/L5 will be 32%/18%/50%/0.5% respectively. It is estimated that the global automotive wiring harness market size will be about 376.3 billion yuan in 2026, of which the market value of ordinary low-voltage/high-voltage/high-speed wiring harnesses will be 257 billion/676 billion/518 billion yuan respectively. It is expected that by 2030, the total scale of the global automotive wiring harness market is expected to exceed 448.4 billion yuan, and the CAGR of the market size of ordinary low-voltage wiring harnesses/high-voltage wiring harnesses/high-speed wiring harnesses from 2023 to 2030 will be 1.0%/14.1%/25.3% respectively.

Looking at the connector and cable market size in detail, we assume that the value of connectors and cables in traditional low-voltage wiring harnesses accounts for 40% and 30%, respectively, and the proportion in high-voltage wiring harnesses increases to about 55% and 35%, the proportion in high-speed wiring harnesses is about 65% and 30%. It is estimated that the global high-voltage/high-speed connector market size in 2026 will be about 37.2/33.6 billion yuan, and the high-voltage/high-speed cable market size will be about 27.0/15.5 billion yuan.

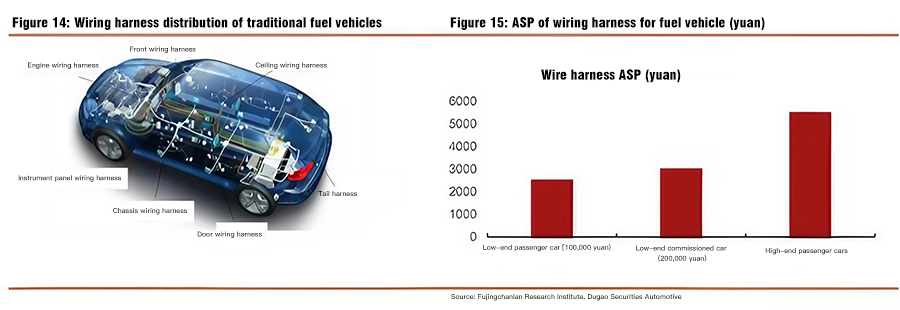

2.1 Ordinary low-voltage wiring harness: the value of a single vehicle ranges from 2,000 to more than 3,000 yuan, covering all parts of the vehicle

Traditional fuel vehicle wiring harnesses are mainly ordinary low-voltage wiring harnesses. Depending on the vehicle level, the ASP for a 100,000 yuan model is 2,000-2,500 yuan, and the ASP for a 200,000 yuan model is 3,000 yuan. The ASP for the wiring harness of a high-end traditional passenger car can reach 5,000-6,000 yuan. According to the application parts, it can be divided into low-voltage wiring harnesses for engine/front cabin/instrument/door/ceiling, etc. In new energy vehicles, the low-voltage wiring harness system with a value of about 200-300 yuan, which is mainly composed of engine wiring harness, is cancelled, and other low-voltage wiring harnesses are basically the same as those in fuel vehicles.

2.2 High-voltage wiring harness: The ASP of a single vehicle increases with the degree of electrification, and the global scale in 2026 will be 67.6 billion yuan

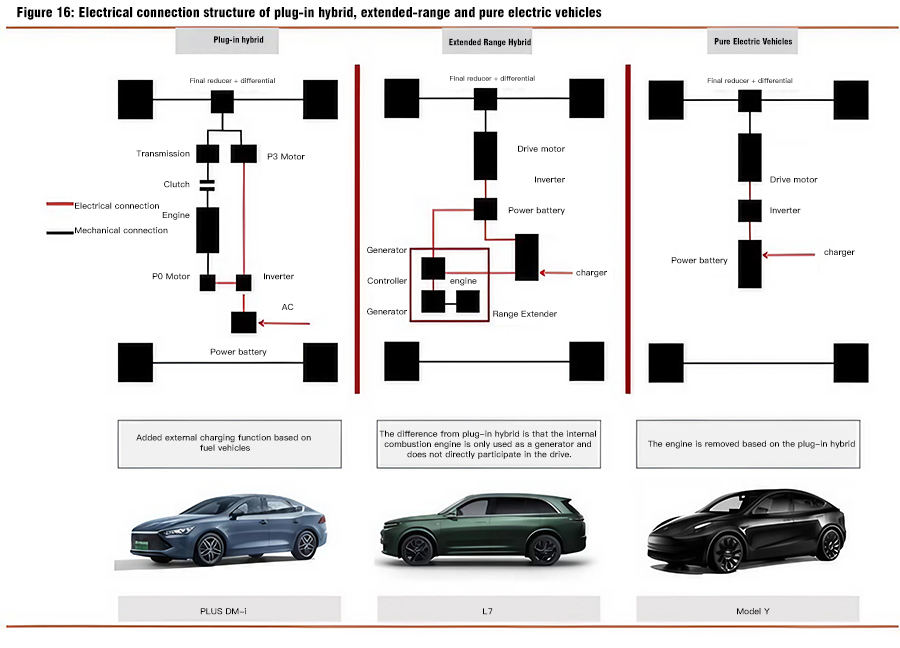

According to the degree of electrification from low to high, cars can be divided into several categories: fuel vehicles, hybrid vehicles, and pure electric vehicles, corresponding to different high-voltage wiring harness structure and performance requirements.

➢ Fuel vehicles: The wiring harness of the entire vehicle is a low-voltage wiring harness, and the value of the high-voltage part is 0 yuan. Traditional fuel vehicles use a 12V low-voltage DC power supply system, and the main source of power for the vehicle is the power generated by the internal combustion engine driving the generator.

➢ Plug-in hybrid (PHEV): Add power batteries, charging, electric drive, and electronic control system components on the basis of traditional fuel vehicles. Plug-in hybrid vehicles can provide two power options, fuel and electric drive, so the battery capacity and motor power are usually smaller than those of extended-range and pure electric vehicles.

➢ Extended-range (EREV): The power system structure is the most complex. In the charging system of the extended-range hybrid vehicle, in addition to external power charging, a new connection circuit is added from the internal combustion engine (range extender) to the battery electric drive system. The extended-range model mainly relies on motor drive, so the battery pack capacity is usually larger than that of PHEV, which can support a longer pure electric driving range.

➢ Pure electric vehicles: The electrical system structure is relatively simple. Compared with fuel vehicles, the low-voltage wiring harness system with a value of about 200-300 yuan, which is mainly composed of engine wiring harnesses, is eliminated. The kinetic energy of pure electric vehicles is 100% provided by high-voltage batteries, so the battery capacity and motor power are the largest, and the performance requirements and value of high-voltage wiring harnesses are the highest.

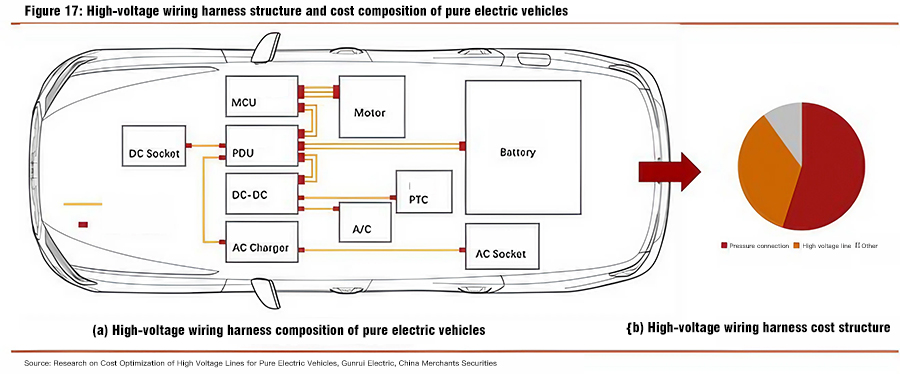

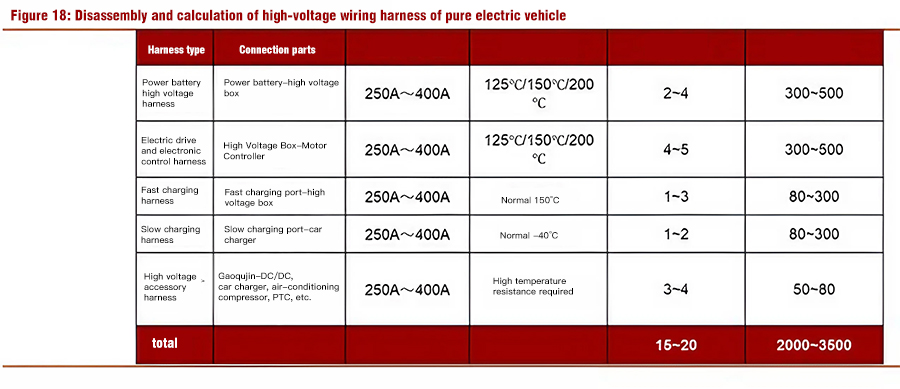

Taking pure electric vehicles as an example, the core application areas of high-voltage wiring harnesses are the three-electric systems in the car, the value of high-voltage connectors and high-voltage cables accounts for more than 90%. Automotive high-voltage wiring harnesses can be divided into 5 parts according to their functions, namely power battery wiring harnesses, electric drive and electric control wiring harnesses, fast charging wiring harnesses, slow charging wiring harnesses, and high-voltage accessory wiring harnesses. The connecting parts include power batteries, drive motors, high-voltage distribution boxes (PDUs), electric compressors, DC/DC, OBC, PTC, etc. Since high-voltage wiring harnesses need to provide current transmission with voltage levels of 60V-800V and above and current levels of 10A-200A and above, the requirements for insulation/heat resistance/anti-electromagnetic interference/protection levels are higher, so the value share of core components is higher than that of ordinary wiring harnesses, it is estimated that high-voltage connectors and high-voltage cables account for more than 55% and 35% of the value share of high-voltage wiring harnesses.

As new energy vehicles become more dependent on electric drive, the value of high-voltage wiring harnesses for the entire vehicle is also increasing, reaching up to around RMB 2,000-3,500. In the process of vehicle electrification, the value of high-voltage wiring harnesses is mainly increased by 1) the increase in high-voltage components and the complexity of the structure, which leads to an increase in the use of wiring harnesses, 2) the increase in the voltage/power of the entire vehicle drives the increase in the transmission power of the wiring harness and the increase in price. We estimate that the total amount of high-voltage wiring harnesses in pure electric vehicles is about 15 to 20, and the unit price ranges from tens to hundreds, which is related to the current size, EMI and other requirements, and can reach up to RMB 2,000-3,500.

Market size estimation:

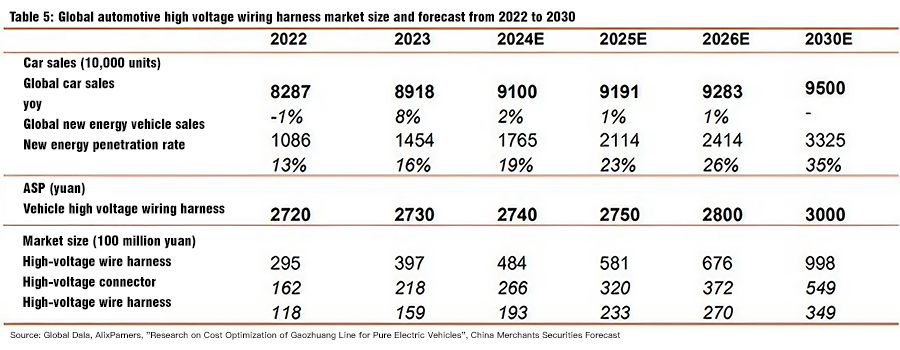

➢ According to global data, we estimate that global automobile sales will be 91 million/919 million/928 million units in 2024-2026, up 2%/1%/1% year-on-year, global total automobile sales are expected to reach 95 million units in 2030. It is estimated that the global penetration rate of new energy vehicles will be 19%/23%/26% in 2024-2026, and 35% in 2030.

➢ Combined with the above analysis, we predict that the value of high-voltage wire harnesses for new energy vehicles will be about 2,000 to 3,500 yuan, which will increase with the increase in the proportion of pure electric vehicles in new energy vehicles.

➢ Overall, the global high-voltage wire harness market size will be about 48.4 billion/58.1 billion/67.6 billion yuan in 2024-2026, up 22%/20%/16% year-on-year. With the continuous increase in the global penetration rate of new energy, it is expected to grow to 99.8 billion yuan in 2030, with a CAGR of +14.1% from 2023 to 2030. Among them, the value of high-voltage connectors and high-voltage cables accounts for about 55% and more than 35%.

2.3 High-speed wiring harness: Intelligent driving, cockpit, and networking are the core application scenarios, and the global scale will exceed 50 billion in 2026

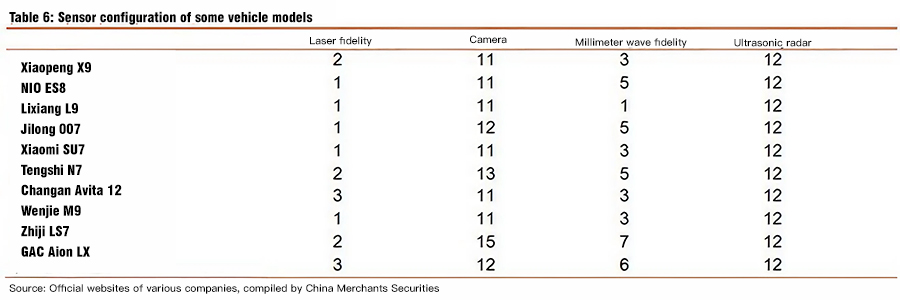

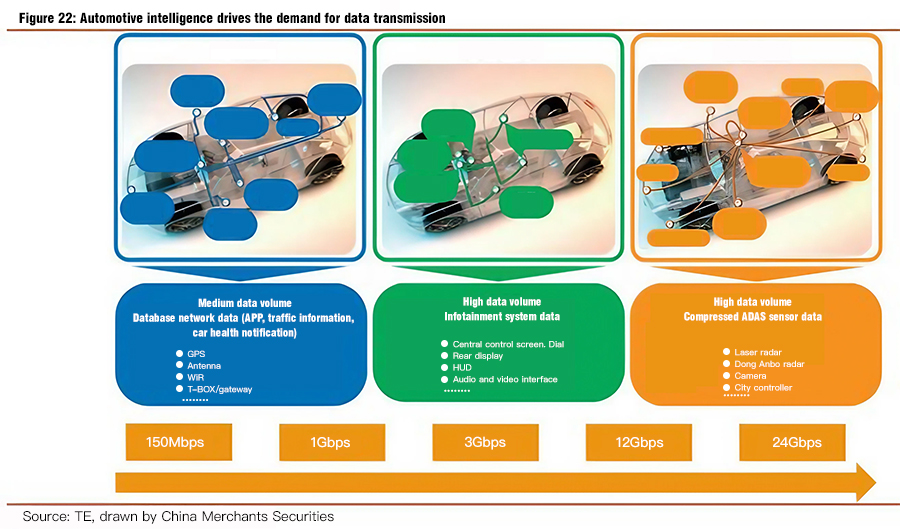

The number of sensors and ECUs in smart cars has increased, and the speed and quality of data transmission have been higher, bringing incremental demand for intelligent wiring harnesses in multiple scenarios and types. The intelligence of automobiles has driven a significant increase in the number of sensors and ECUs in the car, and the growth has increased with the level of autonomous driving. According to Yole's forecast, in the L1 to L2++ autonomous driving stage, the number of cameras is expected to increase from 1 to 2 per vehicle to 3 to 12 per vehicle. The above functions require high-speed transmission of large amounts of data. According to Tyco, the amount of data generated by an autonomous driving car every day is expected to be as high as several TB, which brings requirements for the signal integrity, low latency, and high-speed transmission of the wiring harness.

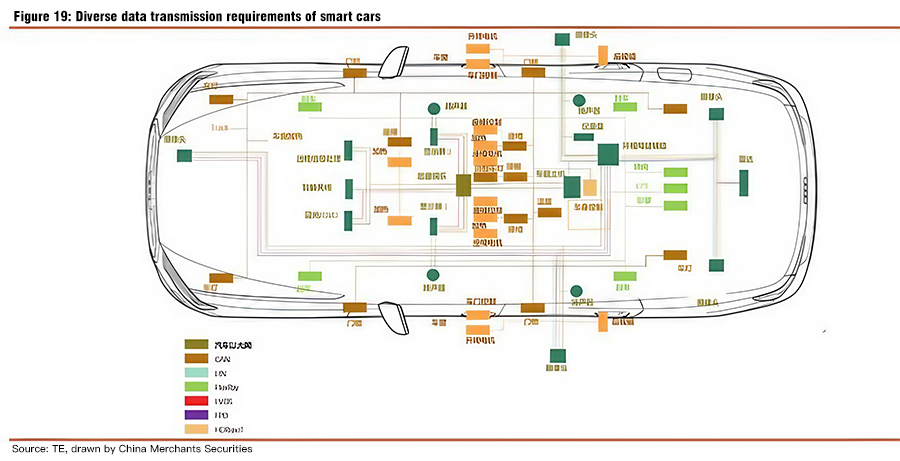

⚫ According to the scenario, intelligent wiring harnesses are commonly found in the three major fields of autonomous driving, smart cockpits, and vehicle networking, and are used for data transmission of related sensors, controllers, and display/execution/interaction devices.

⚫ From the perspective of product type, the demand for wiring harnesses brought about by intelligence is diverse, mainly including:

Ordinary signal wiring harnesses: used for the connection between ordinary sensors and ECUs.

High-speed wiring harnesses: FAKRA/mini-FAKRA/HSD/Ethernet wiring harnesses and other high-speed wiring harnesses, used in automatic driving and infotainment scenarios.

Other special wiring harnesses: such as USB/TypeC/HDMI and other multimedia interfaces for vehicle-machine interaction, as well as ABS/EPB wiring harnesses related to chassis vehicle control, etc.

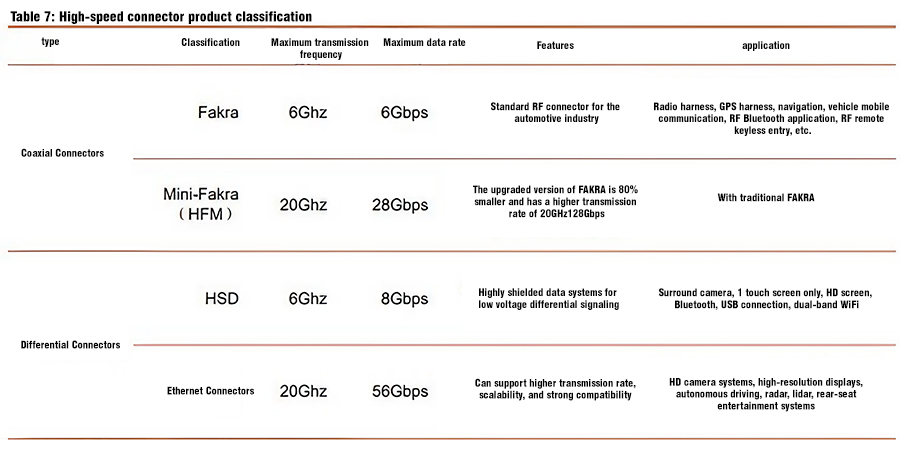

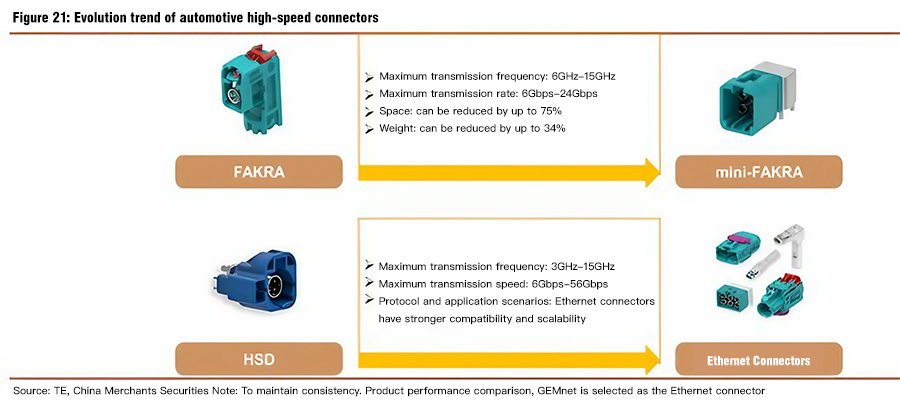

High-speed wiring harnesses are the core wiring harnesses newly added in the process of automobile intelligence, which are specifically divided into four categories: FAKRA, mini-FAKRA, HSD, and Ethernet wiring harnesses. According to Tyco, driven by intelligence, the mainstream data transmission rate of vehicles has expanded from 150Mbps to 24Gbps, giving rise to the application demand for related high-speed connectors and related wiring harnesses. According to different transmission signals, they can be divided into coaxial wiring harnesses for transmitting analog signals, such as FAKRA and mini-FAKRA, and differential wiring harnesses for transmitting digital signals, such as HSD and Ethernet wiring harnesses.

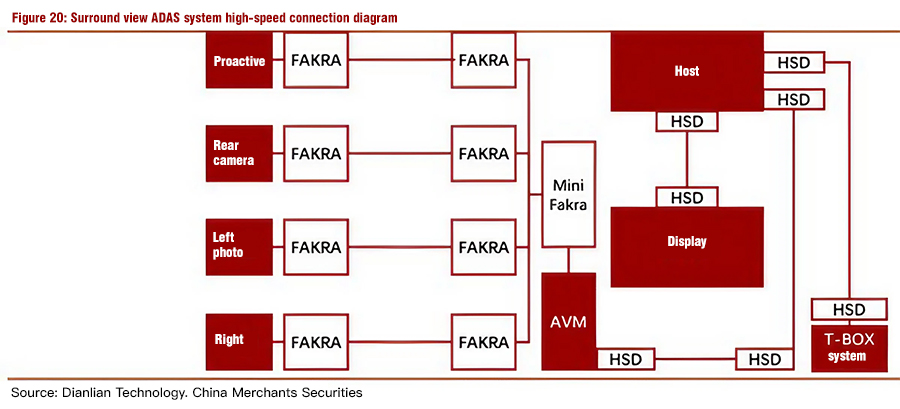

Different high-speed harnesses are often used together to work together. Taking the surround view ADAS system as an example, the vehicle camera is connected to the harness through a FAKRA connector, and the other end of the harness is connected to a mini-FAKRA connector, and the collected data is transmitted to the vehicle surround view system (AVM), then the HSD harness is used to transmit the data to the host, and finally the signal is sent to the cockpit section through the HSD harness for display.

At present, domestic FAKRA/HSD connectors are relatively mature, mini-FAKRA/Ethernet connectors still have a gap with overseas giants in terms of technology and patent accumulation. High-speed connectors are the core of high-speed wiring harnesses. At present, the technical maturity of FAKRA and HSD connectors of domestic manufacturers is relatively high, with clear design and verification standards, and the products are widely used, mini-FAKRA, Ethernet connectors, etc. are still behind overseas giants such as Rosenberger, Tyco, and Molex. Mainly because 1) overseas giants started early in research and development and have significant advantages in the accumulation of key core technologies, 2) overseas giants have built patent barriers through early registration of patents, joint mutual authorization, etc., and through deep binding with whole machine manufacturers and standard alliance organizations, they are further deeply implanted in terminals and transmission protocols to achieve further monopoly.

In the future, mini-FAKRA and Ethernet wiring harnesses are expected to further expand their applications and replace fakra and HSD wiring harnesses. 1) Compared with FAKRA, mini-FAKRA has the same application field, and mini-FAKRA has higher transmission frequency, rate, and integration. 2) Compared with Ethernet connectors, HSD is currently mainly used for data transmission of in-vehicle displays, and the transmission frequency and speed that can be achieved by Ethernet connectors are lower. Ethernet connectors have stronger protocol compatibility, and with the penetration of in-vehicle Ethernet, the application field is more expansive. It is expected that with the significant improvement of in-vehicle entertainment system equipment, the use of HSD will continue to increase in the short term, but in the medium and long term, the application market of HSD connectors will be partially replaced by Ethernet connectors.

Pay attention to the increase in intelligent wiring harnesses brought by intelligent automotive applications such as autonomous driving, smart cockpits, and vehicle networking.

➢ Autonomous driving: Sensor/controller upgrades drive a high increase in the use of FAKRA/HSD/Ethernet wiring harnesses and connectors. 1) Camera: Fakra/Mini-Fakra and HSD wiring harnesses are used together. Among them, FAKRA is mainly used for the connection between the car and the outside, such as shark fin antennas, 360 surround cameras, etc. HSD is mainly used for the transmission of high-speed data inside the car, such as the connection between the host and the display/T-BOX, LVDS, USB2.0/USB3.0/1080P high-definition camera applications. 2) LiDAR: Use Ethernet wiring harnesses and connectors for high-speed transmission. 3) Domain controller: Can simultaneously connect multiple wiring harness types such as low-speed wiring harnesses, HSD, Ethernet wiring harnesses, etc.

➢ Smart cockpit: Display/HUD brings HSD wiring harnesses and connectors, car-machine interconnection drives USB/HDMI growth. 1) Display screen, HUD: According to Gasgoo, the number of screens such as car dashboards/central control screens/HUD/rear seat entertainment continues to grow, and the number of screens per car will increase from 1.9 in 2021 to 2.7 in 2025. At the same time, the in-vehicle central control screen has entered the era of standard 2K high-definition, and will develop towards 4K/8K high-definition in the future, and the demand for wiring harness transmission rate will increase. 2) Multimedia port: Car entertainment interaction and car-machine interoperability functions drive the continued penetration of special wiring harnesses such as in-vehicle USB/HDMI.

➢ Internet of Vehicles: In-vehicle antennas and T-BOX bring high-speed transmission requirements, bringing FAKRA/Ethernet wiring harnesses and connector applications. 1) In-vehicle antenna system: As the transmission rate increases, FAKRA and mini-FAKRA will replace FM/AM feeders and GPS wires for 4GLTE/5G MIMO/Car2Car/WiFi, cellular radio frequency and other function transmissions. 2) T-BOX, Gateway: The hardware form is similar to the domain controller, and the transmission of high-speed data also mainly uses HSD, Ethernet harness, etc.

Market size estimation: It is estimated that the value of high-speed wiring harnesses for a whole vehicle is between 300-1500 yuan, with the improvement of the degree of intelligence and configuration of the car. The value growth of high-speed wiring harnesses comes from both quantity and price. In terms of quantity, the increase in the number of sensors such as cameras, lidars, display screens, and car networking components has led to an increase in demand for high-speed wiring harnesses. In terms of price, the performance requirements of automotive high-speed wiring harnesses such as transmission rate, shielding efficiency, and latency bring high value. For example, high-speed cables need to use dedicated coaxial cables, data cables, etc. to improve the performance of insulation layer shielding, etc., high-speed connectors have technical barriers in electromagnetic microwave performance such as impedance, EMC, and contact wave ratio, as well as special terminal design.

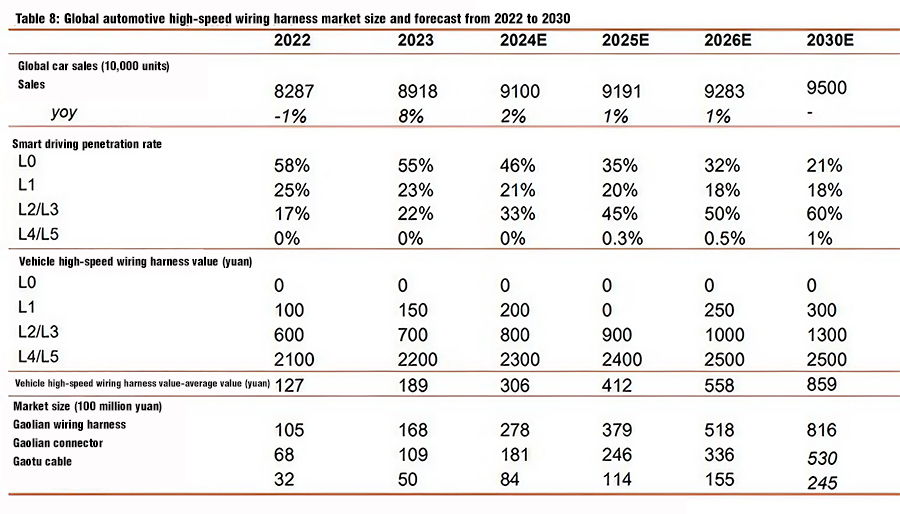

➢ Combining data from ICV TANK and Ruqi Travel, we judge that the penetration rates of intelligent driving L1, L2/L3, and L4/L5 in the global automotive market in 2026 will be 18%/50%/0.5% respectively.

➢ Combined with the previous analysis, we assume that the value of the high-speed wiring harness of L1 autonomous driving level vehicles is about 300~500 yuan. With the improvement of automation level, the value of high-speed wiring harness of L2/L3, L4/L5 intelligent driving vehicles is expected to reach 1000~1500/2000 yuan or more.

➢ Overall, the global automotive market high-speed wiring harness market size is about 27.8/37.9/51.8 billion yuan in 2024/2025/2026, and is expected to grow to 81.6 billion yuan in 2030, with a CAGR of +25.3% from 2023 to 2030. Among them, high-speed connectors and high-speed cables account for more than 65%/30% of the value of high-speed wiring harnesses.

2.4 Summary of this chapter

In summary, we estimate the value of a single vehicle:

1) Traditional fuel vehicles: The wiring harness of the whole vehicle is mainly low-voltage wiring harness. Without considering the increase in intelligence, the value of the wiring harness of the whole vehicle is basically stable at around 2,000-3,000 yuan.

2) Electric vehicles: In the process of automobile electrification, the engine wiring harness is gradually cancelled, but at the same time, a high-voltage system wiring harness is added, which has higher requirements for performance and reliability. The value increment of the high-voltage wiring harness can reach 2,000-3,500 yuan. Without considering the increase in intelligence, the value of the wiring harness of the whole vehicle is about 5,000-6,000 yuan.

3) Smart cars: In the process of automobile intelligence, functional attributes such as autonomous driving, smart cockpits, and vehicle networking have put forward higher requirements for data transmission speed. Depending on the different intelligent configurations of the vehicle, the value of the newly added high-speed wiring harness ranges from a few hundred to 1,500 yuan+.

In terms of market size:

With the continuous penetration of electrification and intelligence, the market size of high-voltage and high-speed wiring harnesses for vehicles is expected to continue to grow. We estimate that the total size of the global automotive market wiring harness in 2026 will be 376.3 billion yuan, of which the market value of ordinary low-voltage/high-voltage/high-speed wiring harnesses will be 257 billion/676 billion/518 billion yuan respectively. By 2030, the total size of the global automotive market wiring harness will be 448.4 billion yuan, of which the market value of ordinary low-voltage/high-voltage/high-speed wiring harnesses will be 267 billion/998 billion/816 billion yuan respectively.

1) Traditional low-voltage wiring harness: It is estimated that the total sales volume of the global automotive market in 2026/2030 will be 928.3 million/95 million units, and the estimated global automotive ordinary wiring harness market size in 2026/2030 will be 257 billion/267 billion yuan, which will remain stable overall. In terms of subdivision, the value of connectors and cables in traditional low-voltage wiring harnesses accounts for approximately 40% and 30% respectively.

2) High-voltage wiring harness: It is estimated that the global penetration rate of new energy vehicles will reach 26%/35% in 2026/2030. As the penetration rate of new energy vehicles increases, the global automotive high-voltage wiring harness market size is estimated to be 67.6 billion/99.8 billion yuan in 2026/2030. In terms of subdivision, assuming that the value share of connectors and cables in high-voltage wiring harnesses increases to 55% and 35%, the high-voltage connector market size in 2026/2030 is estimated to be 37.2 billion/54.9 billion yuan.

3) High-speed wiring harness: It is estimated that the penetration rate of global automotive L1, L2/L3, L4/L5 autonomous driving will be 18%/50%/0.5% in 2026, and will further increase to 18%/60%/1% in 2030. The global high-speed wiring harness market size in 2026/2030 is estimated to be 51.8 billion/81.6 billion yuan. In terms of details, assuming that the value share of connectors and cables in high-speed wiring harnesses increases to 65% and 30%, the estimated market size of high-speed connectors in 2026/2030 will be 33.6 billion yuan/53 billion yuan.